The prospect of looking for a mortgage when you will have unfavorable credit ratings could cause individuals a number of nervousness. It’s possible you’ll assume that due to your poor credit score historical past, no financial institution would ever lend you the cash. So why even apply? Effectively, what if we informed you that no matter your credit score historical past, many lenders are keen to mortgage YOU cash? It’s true! And as we speak we’ll be educating you all about discover unfavorable credit ratings residence loans.

On this article, we’re going to cowl what it’s worthwhile to know to get authorized with unfavorable credit ratings:

- How credit score scores are calculated and how one can shortly enhance your quantity

- What the debt-to-income ratio is and why lenders use this indicator

- Who qualifies for FHA loans and different packages out there for residence patrons

Don’t waste one other second permitting your credit score rating to maintain you away from the magical feeling of homeownership.

Discover assets for unfavorable credit ratings residence loans by state and by metropolis!

We Can Assist You Get Certified Even With Low Credit score

Fill Out The Kind Under To Get Assist At present! Article continued after type

Discovering a lender to present you a mortgage with a low credit score rating is our specialty. Nonetheless, you’re going to run into some points that it’s essential to learn about forward of time.

When your credit score rating dips under the typical mark of 620, to assist defend the financial institution’s preliminary funding, many lenders might require:

- Greater Down Funds

- Mortgage Insurance coverage

- Greater Curiosity Charges

The distinction of even just a few factors may have a main affect on the amount of cash it can save you on a mortgage.

Because of this we extremely encourage you to educate your self in your credit score rating.

In the long term, a better credit score rating may prevent hundreds of {dollars}.

Compensating Elements to Overcome a Low Credit score Rating

It’s no secret that your credit score rating is extraordinarily essential to lenders who take into account issuing you some form of residence mortgage. Your creditworthiness provides the lender some safety; you might be prone to pay again your house mortgage in full. A low credit score rating may point out that you just’re extra prone to default in your mortgage.

To make up for the danger, many lenders will provide potential residence patrons the chance to give you compensating elements.

Down Cost

Everyone advantages from it no less than for a while

The commonest compensating issue is the down fee. Historically, lenders have required a twenty p.c down fee for typical mortgage packages. When you have been to take a look at the numbers, which means you would wish $20,000 for a $100,000 residence.

It’s a method for the lender to make sure that they’ve some safety if debtors go into default on their unfavorable credit ratings residence loans. When the house strikes into foreclosures, the financial institution can relaxation assured that they are going to recoup a good portion of their cash because of this good-looking down fee.

When you’ve got a low credit score rating, lenders might require a bigger down fee upfront to attenuate their total danger. This compensating issue will apply to traditional mortgage loans. Additionally, FHA loans for unfavorable credit ratings, VA loans, and different kinds of residence mortgage merchandise require some down fee.

How a lot must you plan to place down in the event you’re a first-time purchaser with unfavorable credit ratings? Sadly, there isn’t a one-size-fits-all reply with regards to a down fee that will make up for poor credit score. The thought is solely that you’ll have extra fairness within the residence, which is healthier for the monetary establishment who’s loaning you the cash. It’s best to plan to have a fairly sizeable down fee with regards to unfavorable credit ratings residence loans although.

Mortgage Insurance coverage

So typical and so interesting

Along with a bigger down fee, lenders might require mortgage insurance coverage for a first-time purchaser with unfavorable credit ratings or another sort of unfavorable credit ratings residence loans. Such a insurance coverage is usually known as PMI (non-public mortgage insurance coverage), and its main goal is to defend the lender.

Mortgage insurance coverage is often required on all typical residence loans which have a down fee decrease than twenty p.c. It lowers the general danger to a lender, nevertheless it additionally will increase the month-to-month price of your house.

The typical price for personal mortgage insurance coverage varies based mostly on the general mortgage quantity. Sometimes, the price will vary wherever from 0.3 p.c to 1.5 p.c of the house’s whole price annually.

How does that translate into real-world numbers?

When you bought a house on the nationwide common worth of $203,000, your mortgage insurance coverage may price wherever from $609 to $3,045 yearly ($50.75 to $253.75 per thirty days). This can be a vital price that would put some houses nicely outdoors the realm of what’s inexpensive for potential patrons.

In some circumstances, you could possibly get the non-public mortgage insurance coverage eliminated as soon as sufficient fairness is constructed up within the residence. The small print in your mortgage might range, however some monetary establishments will enable householders to request the cancellation of PMI once they have the equal of a twenty p.c down fee invested into the home.

Some packages, just like the FHA loans for unfavorable credit ratings and others for a first-time purchaser with unfavorable credit ratings, might require mortgage insurance coverage in the course of the mortgage. Whereas it is a vital month-to-month price, it does will let you personal your very own residence as an alternative of hire.

Credit score Scores

Do you ever marvel precisely what your lender is speaking about once they begin mentioning your credit score rating? Even a hire to personal for unfavorable credit ratings might reference this elusive quantity. However just a few individuals actually perceive what it means or the place it comes from. Earlier than you are able to do any work in your credit score rating, it’s a must to know what this all-important quantity means and the way it’s calculated.

How Do They Come Up with Credit score Scores?

Take a look at the statistics and you can be extra ready

A credit score rating is one of the best ways lenders can choose your total monetary well being. It features a complete look at each essential space that impacts your long-term funds.

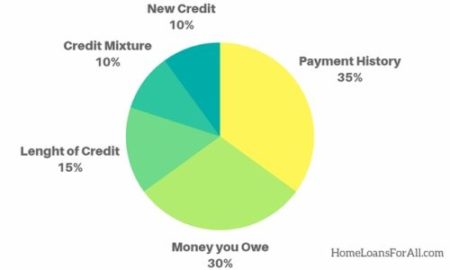

Many lenders are literally taking a look at your FICO credit score rating earlier than figuring out whether or not you qualify for unfavorable credit ratings residence loans. This quantity is set by means of sophisticated calculations that weigh 5 main areas associated to your monetary well being:

- Your fee historical past (35%)

- Amount of cash you owe (30%)

- The size of your credit score historical past (15%)

- Your credit score combination (10%)

- New credit score (10%)

Every of those classes is weighted barely in another way with regards to calculating your total credit score rating. You possibly can see the precise illustration of the standard percentages within the parentheses that observe. Nonetheless, these numbers may range barely relying in your actual credit score historical past.

For instance, first-time patrons with unfavorable credit ratings might not have a protracted credit score historical past which is able to shift the general weight of every class considerably.

It needs to be famous that your credit score rating is way totally different than the extra simplistic credit score report. You’re entitled to a free credit score report from every of the three main credit score reporting bureaus annually (Equifax, Transunion, and Experian). These studies are designed to element your precise fee historical past together with any occasions the place you have been late on funds or missed them altogether.

As compared, your credit score rating takes this info into consideration however balances it with different key particulars. It’s a straightforward method for lenders to rank your monetary well being in comparison with different shoppers who’re additionally making use of for a traditional mortgage or unfavorable credit ratings residence loans.

The knowledge contained inside your credit score report is a figuring out issue for calculating your total credit score rating. It’s possible you’ll uncover that you’ve got a number of credit score scores and that every one is barely totally different. It’s because every credit score reporting company may have totally different info concerning your historical past.

What’s a Unhealthy Credit score Rating?

Lenders decide in your creditworthiness based mostly on the ultimate quantity assigned to your monetary historical past. The credit score rating ranking scale usually runs from 300 factors to 850 factors, although you might even see some variation relying on the precise scale used. It doesn’t matter what, a better quantity represents a greater credit score rating.

There may be by no means a credit score rating too dangerous! You possibly can at all times enhance it!

To find out how a lender would price your credit score rating, you possibly can see which of those brackets you fall into. These are the overall tips that many monetary establishments will use to find out the charges related along with your mortgage or any sort of unfavorable credit ratings residence loans.

- Unhealthy: 300 to 499

- Poor: 500 to 579

- Low: 580 to 619

- Common: 620 to 679

- Good: 680 to 699

- Wonderful: 700 to 850

The next credit score rating comes with extra favorable phrases and merchandise out there for shoppers. Alternatively, a decrease credit score rating (like these seen for unfavorable credit ratings residence loans) tends to warrant greater charges and rates of interest for potential residence patrons.

When your credit score rating dips under the typical mark of 620, many lenders turn into hesitant to subject a traditional mortgage product. They might require greater down funds and mortgage insurance coverage, or chances are you’ll face greater rates of interest to assist defend the financial institution’s preliminary funding. FHA loans for unfavorable credit ratings are tough to seek out for people who’ve a credit score rating under 620.

Debt-to-Earnings Ratio

A debt-to-income ratio (typically denoted as DTI) is one other key measure utilized by lenders to find out the small print of a mortgage product. This quantity is an indicator that compares your total debt to the quantity of revenue you will have every month. Lenders are in the end looking for people who’ve a decrease ratio. Small DTI demonstrates an incredible stability and means you usually tend to pay payments in a well timed method.

How do you calculate your debt-to-income ratio? The calculation is definitely fairly easy when you’ve got a very good deal with in your month-to-month payments and debt.

Seize a calculator and a stack of your month-to-month payments to tally up the overall quantity of recurring month-to-month money owed you will have (together with pupil loans, auto loans, bank card debt, and another cash you will have borrowed). Divide this quantity by your gross month-to-month revenue and multiply the reply by 100.

Are you good at maths?

This offers you an total share that tells you the way a lot of your out there revenue is used to pay down your debt on a month-to-month foundation.

To present you an instance utilizing real-world numbers, let’s suppose that your month-to-month debt incurs payments that appear to be these:

- Scholar loans: $400 per thirty days

- Auto Mortgage: $250 per thirty days

- Bank card debt: $180 per thirty days

- Private mortgage: $120 per thirty days

Altogether, you pay roughly $950 per thirty days to cowl the price of the cash you borrowed previously. Suppose that your gross month-to-month revenue is $3,500 {dollars}. Once you divide $950 by $3,500 and multiply by 100, you can find a debt-to-income ratio of roughly 27 p.c.

What’s Unhealthy Debt-to-Earnings Ratio?

As soon as you realize what your debt-to-income ratio truly is, it’s affordable to marvel what share is taken into account “dangerous” by lenders. This is a vital issue for acquiring a mortgage for a first-time purchaser with unfavorable credit ratings or any sort of unfavorable credit ratings residence loans. In any case, research have proven that people who’ve a better ratio usually tend to battle with paying their month-to-month payments.

Most lenders will seek for debtors with a DTI of lower than 43 p.c.

This debt-to-income ratio could be calculated each with and with out the brand new mortgage you’re making use of for. If it contains your preexisting debt together with the potential unfavorable credit ratings residence loans, lenders usually need to see a ratio below 45 p.c. They might be inclined to nonetheless subject a mortgage if there are compensating elements.

Lenders should be certain that you’ll nonetheless find the money for left on the finish of the month to cowl on a regular basis incidentals that aren’t factored into this ratio. These can embody your utilities, telephone invoice, web invoice, groceries, and gasoline to your automobile. With out cash left over, you gained’t be capable of cowl these prices and are prone to default on no less than one in every of your different funds.

Unhealthy Credit score Mortgage Loans

You’ve completed the analysis and also you already know that you’ve got poor credit score. Maybe you filed for chapter previously otherwise you had a house transfer into foreclosures. Apart from engaged on enhancing your credit score historical past, you continue to have loads of choices for unfavorable credit ratings mortgage loans. Whether or not you reside in New York or California or wherever between, you need to look into authorities packages to find out in the event you meet the necessities.

There are three main authorities packages that supply unfavorable credit ratings mortgage loans to people with unfavorable credit ratings. These three heroes are FHA loans for unfavorable credit ratings, VA loans, or USDA loans. You should decide with of those unfavorable credit ratings mortgage loans may be best for you:

- FHA Loans: These residence loans are finest for people who need a particularly low down fee however don’t thoughts paying mortgage insurance coverage in the course of the mortgage.

- VA Loans: VA loans include no down fee and low-interest charges, however you should be a veteran with the intention to qualify.

- USDA Loans: These unfavorable credit ratings mortgage loans are ultimate for individuals who need to buy a house in a rural space with little to no down fee, however they are going to require a barely greater credit score rating.

FHA Loans

Federal Housing Administration? Moderately Truthful Residence Loans Administration!

The FHA loans for unfavorable credit ratings are assured partly by the Federal Housing Administration. This system is designed to make lenders really feel safer. They’re extra keen to subject loans to people who’ve unfavorable credit ratings, first-time residence patrons. When you default on the mortgage, the federal authorities will assist to cowl the price of the default to your non-public lender.

These unfavorable credit ratings residence loans all have one very distinguished benefit that first-time patrons with unfavorable credit ratings ought to pay attention to.

Low Down Cost

A low down fee is pretty common on FHA loans for unfavorable credit ratings. This one attribute is what makes many first-time patrons with unfavorable credit ratings flock to this particular authorities program. It’s possible you’ll pay as little as 3.5 p.c in a down fee with a FICO credit score rating of 580 or greater.

If you’ll find a lender keen to subject FHA loans for unfavorable credit ratings, people with decrease credit score scores should still be capable of qualify with a barely bigger down fee. Decrease credit score scores usually require a ten p.c down fee. This decrease down fee gives a wonderful alternative for people and householders to save cash.

Figuring out how a lot it can save you is a little bit difficult, so we’ll check out some actual numbers. The typical sale worth for a house in the US is roughly $200,000. A traditional mortgage product would require a $40,000 down fee. By comparability, a 3.5 p.c down fee would equate to $7,000, and a ten p.c down fee would equal $20,000.

Owners may save as much as $33,000 on this state of affairs by selecting to go together with FHA loans for unfavorable credit ratings.

Saving up for the down fee on a brand new residence is usually essentially the most time-consuming a part of the method for potential patrons. It will possibly take years to scrape collectively sufficient financial savings to withdraw $40,000 out of your checking account. By comparability, the FHA loans for unfavorable credit ratings make the preliminary necessities considerably extra accessible.

FHA Necessities

Many lenders make the most of the identical common tips to qualify potential patrons for these unfavorable credit ratings residence loans. Nonetheless, you need to remember the fact that the precise necessities might range barely relying on the lender.

Many lenders make the most of the identical common tips to qualify potential patrons for these unfavorable credit ratings residence loans. Nonetheless, you need to remember the fact that the precise necessities might range barely relying on the lender.

Apart from a down fee that ranges from 3.5 to 10 p.c based mostly in your credit score rating, you should additionally meet these necessities.

- Debt-to-Earnings Ratio

You have to meet sure debt-to-income ratio numbers with the intention to qualify below a lot of the FHA loans for unfavorable credit ratings.

Your front-end debt-to-income ratio (mortgage fee, insurance coverage, property taxes, and personal mortgage insurance coverage) ought to equal 31 p.c of your gross month-to-month revenue. Lenders might approve a mortgage for candidates who’ve a front-end DTI of as much as 40 p.c when you’ve got some compensating elements.

Your back-end ratio (all month-to-month debt funds plus the price of the brand new mortgage) needs to be 43 p.c or much less of your whole month-to-month revenue. Just like your front-end DTI, some lenders will approve greater back-end ratios of as much as fifty p.c with compensating elements.

- Credit score Rating

Most lenders would require a credit score rating of 500 or greater to qualify you for FHA loans for unfavorable credit ratings. Nonetheless, that is truly decided on a case-by-case foundation by every particular person lender that provides FHA loans for unfavorable credit ratings. They may weigh your credit score historical past and any potential bankruptcies or foreclosures to find out if there have been extenuating circumstances past your management. To be able to obtain the most quantity of financing, you should have a credit score rating of 580 or greater.

Decrease credit score scores within the 500 to 579 vary will often require a ten p.c down fee at minimal.

Not like some typical merchandise, you possibly can settle for a financial present from a member of the family to cowl the preliminary down fee.

- Property Necessities

The property necessities for FHA loans for unfavorable credit ratings are literally comparatively easy to adjust to. Every potential residence should have a present appraisal and inspection to make sure that it complies with minimal property requirements associated to well being and security. For instance, your appraisal ought to embody the situation of things corresponding to:

- Plumbing

- Electrical energy

- Septic techniques

- Basis points

- HVAC system functioning

If the house can’t meet requirements that will indicate that’s good to your well being and security, these FHA loans for unfavorable credit ratings can be derailed indefinitely. The house should even be used as your main residence.

- Mortgage Insurance coverage

It needs to be famous that FHA loans for unfavorable credit ratings would require non-public mortgage insurance coverage all through the length of the mortgage, significantly in the event you had a down fee decrease than ten p.c. This will add as much as a major price over the thirty-year length of most FHA loans for unfavorable credit ratings.

A $200,000 residence may require annual mortgage insurance coverage starting from $600 to $3,000. At this price, you’d be paying an extra $18,000 to $90,000 over the course of a thirty-year mortgage.

Owners who put down ten p.c or extra in the direction of their unfavorable credit ratings residence loans might qualify to take away their mortgage insurance coverage after eleven years. Many first-time patrons with unfavorable credit ratings might need to take into account growing their financial savings with the intention to qualify for this vital benefit.

The FHA program is a superb choice for people who want unfavorable credit ratings residence loans. The low down fee could make homeownership a extra fast actuality regardless of the necessity for mortgage insurance coverage every month.

VA Loans For Unhealthy Credit score

A VA mortgage is a novel unfavorable credit ratings residence mortgage choice out there by means of non-public lenders that options authorities backing. A portion of every mortgage is assured by the Division of Veterans Affairs for eligible people. Very like the FHA loans for unfavorable credit ratings, lenders are extra apt to contemplate candidates who wouldn’t qualify for a extra conventional mortgage program.

The federal authorities will insure a selected portion of the mortgage (often as much as $36,000) for eligible service members if the customer defaults on the mortgage. There are vital benefits that include a VA mortgage, even these issued as unfavorable credit ratings residence loans for eligible people and households.

There are vital benefits that include a VA mortgage, even these issued as unfavorable credit ratings residence loans for eligible people and households.

Maybe essentially the most vital perk of this program is that lenders might not require any down fee in any respect. Non-public mortgage insurance coverage premiums are additionally waived for these unfavorable credit ratings residence loans.

Easy benefits of those mortgage packages can save potential patrons hundreds of {dollars} over the course of their mortgage time period. That is what makes them ultimate as unfavorable credit ratings mortgage loans for individuals who qualify.

Can you qualify for these favorable residence loans? Fewer people qualify for this program since you should meet particular tips concerning service within the armed forces. You could find out extra in regards to the particular necessities under.

No minimal credit score rating

VA loans are nice unfavorable credit ratings residence loans for people who’ve unfavorable credit ratings. The federal authorities doesn’t specify a minimal credit score rating with the intention to again the mortgage with a non-public lender. As a substitute, they encourage lenders to take a more in-depth have a look at every software and take into account your info on a case-by-case foundation.

You can qualify even in the event you’re a first-time purchaser with unfavorable credit ratings or no credit score.

Every lender might set out their very own credit score rating standards to subject loans to potential patrons. The usual benchmark for a lot of lenders is a credit score rating of 620, however there are many choices for people with decrease credit score scores as nicely. Lenders usually tend to take a danger on less-qualified candidates due to the backing of the federal authorities.

The federal government has no particular credit score necessities, which suggests they are going to insure a portion of the mortgage so long as you discover a lender who will work with you. When you face rejection at one monetary establishment for these unfavorable credit ratings residence loans, don’t surrender. You possibly can at all times apply elsewhere with one other alternative for fulfillment.

Acquiring Your Certificates of Eligibility

A VA mortgage is a superb choice for people and households who want unfavorable credit ratings residence loans, however you should meet a stringent set of standards to qualify. Lenders would require you to acquire a Certificates of Eligibility based mostly on the period of time you have been enlisted in a department of the armed forces. Relying on the time interval and the variety of years you spent in service, these necessities could be difficult to calculate.

For extra info concerning the standards to qualify for a certificates of eligibility, you possibly can test the service necessities right here.

USDA Unhealthy Credit score Residence Loans

Do you dream of proudly owning a house within the nation? In that case, a USDA residence mortgage might enable you to make your goals right into a actuality. These residence loans are backed by the US Division of Agriculture to encourage householders to buy properties in eligible rural and suburban areas.

Just like the VA loans and FHA loans for unfavorable credit ratings, the USDA typically backs a portion of the mortgage. In flip, non-public lenders usually tend to grant approval for loans to potential patrons who don’t meet their customary standards.

Not like the FHA loans for unfavorable credit ratings, chances are you’ll qualify for a direct mortgage from the Division of Agriculture. Candidates who obtain such a direct mortgage usually have very low to low month-to-month incomes, although the precise necessities will range based mostly in your location.

Among the finest options of a USDA mortgage is the key financial savings it could entail for potential patrons. Many eligible properties might will let you make a purchase order and not using a down fee or with a really minimal down fee, relying on the specifics of your mortgage.

Greater Credit score Rating Required

Sadly, USDA loans do require a barely greater credit score rating than the FHA loans for unfavorable credit ratings. Many lenders will need to see a regular 640 credit score rating or greater with the intention to obtain extra streamlined processing of your mortgage. That doesn’t essentially imply that you just gained’t obtain funding below this program.

Candidates who’ve a credit score rating below the 580 mark should still be capable of obtain one in every of these mortgages. Candidates who’ve a better credit score rating are often topic to automated underwriting, nevertheless it isn’t the one choice. A decrease credit score rating merely signifies that you’ll have to undergo handbook underwriting to find out in case you are eligible to obtain one in every of these unfavorable credit ratings residence loans.

Throughout handbook underwriting, an precise particular person will evaluation the small print situated in your credit score historical past and software. Whereas this will decelerate the general course of, chances are you’ll discover that it really works out in your favor. Your private info has the eye of an actual one who can take extenuating circumstances into consideration.

This additionally signifies that your approval might be extremely subjective. The place one lender might agree that you need to qualify, one other should still flip down your software for unfavorable credit ratings residence loans. Don’t be discouraged by these discrepancies. As a substitute, you have to to proceed to strive at different monetary establishments which may be inclined to take a higher danger.

USDA ultimately needs you to maneuver out of city and turn into a very good neighbor within the suburbs. Individuals of sure professions, like nurses, lecturers, policemen, are very a lot welcome to make use of USDA. Good neighbors are at all times welcome wherever.

Compensating Elements

When you’ve got a decrease credit score rating, your underwriter is probably going to check out different compensating elements to find out your eligibility. Many householders could also be required to give you easy objects corresponding to a bigger down fee that would decrease the general month-to-month price of your mortgage.

In different cases, they might have a look at what money reserves you’ll have left following your official closing ceremony. Lenders need to see a number of months’ price of mortgage funds remaining in your checking account. To a lender, which means they’re assured a higher probability of receiving your month-to-month mortgage fee even when you’ve got some extenuating circumstances or surprising payments that month.

They might additionally take into account whether or not you might be assured to obtain a promotion or increase within the close to future. When month-to-month revenue is predicted to extend, it could dramatically alter your debt-to-income ratio and make you a extra interesting applicant.

A handbook underwriter will even take into account what you might be presently paying your hire or mortgage compared to the house you need to buy with a USDA mortgage. Month-to-month funds that may stay comparatively steady will exhibit you can deal with the monetary burden this new mortgage may impose. To be able to decide in the event you can responsibly deal with the change, they are going to have a look at your credit score historical past and measure what number of hire or mortgage funds you will have issued on time.

Lease to Personal Choices

A hire to personal is an interesting choice for a lot of potential patrons who might not qualify for any unfavorable credit ratings residence loans within the current second. They’ll transfer into a house proper now whereas they make modifications that enhance their total credit score rating. First-time patrons with unfavorable credit ratings who’re desperate to make a home into a house might need to examine one in every of these choices for hire to personal with unfavorable credit ratings.

How Does It Work?

Many residence patrons are questioning how this hire to personal state of affairs works. To be able to provide the finest concept of what a hire to personal with unfavorable credit ratings will actually appear to be, we’re going to contemplate it with some real-world numbers.

You’ll begin wanting round for houses which are provided below this class. You could possibly discover them by means of a neighborhood actual property agent, the newspaper, or by way of on-line listings. The month-to-month price is often corresponding to what you’d pay in hire or for a brand new mortgage, however a few of this hire truly goes towards the acquisition worth of the house.

Let’s suppose that the house you discover is price the identical as a median residence worth in the US at roughly $200,000. Which means your hire fee might be in a variety of $1,200 to $1,800 per thirty days, relying on the world you reside in and what’s included in your hire.

Of this month-to-month hire fee, a small portion might be put aside to go towards the acquisition worth of the house. This may range based mostly in your particular contract, however it might be $200 to $400 per thirty days.

Along with your month-to-month hire fee, a hire to personal for unfavorable credit ratings often requires an choice payment. Which means you’ll have the choice of buying the house as soon as the contract is over in just a few years. Just like a down fee, this feature payment will often be a number of thousand {dollars} and characterize a good portion of the acquisition worth of the house.

Execs

Clearly, there are a number of benefits to choosing hire to personal for unfavorable credit ratings situations. Essentially the most engaging choice for such a buy is you can transfer into the house instantly as an alternative of ready a number of years to qualify for a mortgage. Throughout the time you reside there, you possibly can dedicate your self to sprucing your credit score rating to qualify for a mortgage or extra favorable phrases.

The opposite main advantage of a hire to personal for unfavorable credit ratings is {that a} portion of your hire is put aside towards the acquisition worth of your house. This can be a assured quantity every month that doesn’t range based mostly on the quantity of discretionary revenue you will have left on the finish of the month. It will possibly assist to decrease the acquisition worth of the house as a result of it’s a form of compelled financial savings account for people who hire to personal with unfavorable credit ratings.

As a result of the housing market is consistently altering, a hire to personal for unfavorable credit ratings means that you can lock within the worth based mostly on the present market worth. If financial indicators are displaying that the housing market is prone to improve over the approaching years, it may be a good time to lock in a wonderful worth.

Cons

Together with all the benefits of a hire to personal for unfavorable credit ratings, you should still discover just a few drawbacks when in comparison with unfavorable credit ratings residence loans. The obvious drawback to this state of affairs is the massive upfront choice payment to buy the house in years to come back. Just like saving up for a big down fee, it could take first-time patrons with unfavorable credit ratings a while to scrape up the cash required.

There may be additionally sure to be some uncertainty over whether or not you’ll truly qualify for a mortgage when the settlement is up.

When you do determine to maneuver ahead with the hire to personal for unfavorable credit ratings and qualify for a mortgage, there’s a risk you possibly can face greater rates of interest. The market charges are continuously fluctuating, so it may be tough to foretell the place the charges might be in 5 years or so. That is an inherent danger of signing the contract for a hire to personal property.

Foreclosures occur. If the proprietor of the house defaults on the present mortgage, you possibly can nonetheless be compelled to depart. If this occurs, you possibly can lose all the cash you set down for the upfront choices payment and the cash put aside on a month-to-month foundation.

Equally, you’ll lose all of this cash in the event you determine to terminate the contract with the proprietor. It’s possible you’ll understand that this isn’t the correct residence for you after you progress in or chances are you’ll determine that isn’t as inexpensive as you as soon as thought. It doesn’t matter what the rationale, contract termination of a hire to personal for unfavorable credit ratings will price you a fairly penny.

What to Look For

Once you search for hire to personal with unfavorable credit ratings, you continue to want to make sure that you’re on the lookout for the correct sort of property to your wants. A very powerful factor to seek for is a house that you realize you possibly can afford long-term. When you train your proper to buy a hire to personal for unfavorable credit ratings, you have to to make the mortgage fee on time every month. An inexpensive residence could also be crucial consideration a potential purchaser can actually search for.

Nonetheless, you also needs to confirm that the property is totally free and away from any liens. Within the occasion that the proprietor doesn’t at all times make well timed funds, one other firm might have positioned a lien in opposition to the house. This generally is a headache when it comes time to switch the property out of your lease to a brand new mortgage.

Potential patrons for a hire to personal with unfavorable credit ratings must have a transparent contract with the proprietor of the property. It ought to spell out all monetary obligations of each events, your particular choice to buy on the finish of the lease, and the parameters of your funds.

Don’t get too excited a couple of particular hire to personal for unfavorable credit ratings till you have a house inspection carried out on the property. This will help you to determine any main structural points and provide the proper to start negotiating the property worth based mostly on these mandatory repairs. An inspection will even offer you some info to assist decide whether or not this specific hire to personal for unfavorable credit ratings is priced at truthful market worth.

Cosigner on a Unhealthy Credit score Mortgage

Co-signer = TRUST

In case your credit score isn’t adequate to qualify for a mortgage by yourself, a cosigner could possibly offer you a much-needed enhance. Your co-signer doesn’t have to really reside within the property with the intention to enable you qualify for a brand new mortgage. Nonetheless, they’re putting their credit score on the road to your mortgage.

A possible lender will pull the credit score for each the occupant and the cosigner. Your cosigner’s identify and credit score rating turn into tied to the mortgage, for higher or worse. Late or missed funds will present up as a blemish on the cosigner’s credit score report. Moreover, they might be on the hook for making funds in the event you miss them.

The stipulations on cosigning will range based mostly on the precise sort of mortgage you apply for. We are going to take a more in-depth have a look at two of the extra frequent unfavorable credit ratings residence loans.

Standard Mortgages

In case you are making use of for a traditional mortgage with a cosigner, each of your credit score scores might be assessed to find out eligibility. Debt-to-income ratios will range based mostly on each your quantity and your cosigner’s quantity. For instance, the one who will bodily occupy the property might have a debt-to-income ratio of as much as 70 p.c. The cosigner’s required debt-to-income ratio will range.

A traditional mortgage with a cosigner would require the cosigner to signal the precise mortgage itself, however their identify doesn’t must be on the title.

FHA Loans

The main distinction between typical mortgages and FHA unfavorable credit ratings residence loans with a cosigner is the property title. Your cosigner might be on each the mortgage and the title of the property. You could have as much as two non-occupying cosigners on the mortgage itself.

The credit score scores of each the applicant and the cosigners will nonetheless be pulled for FHA loans for unfavorable credit ratings. The utmost debt-to-income ratio might be similar to that required for a traditional mortgage on this state of affairs.

There are additionally particular necessities concerning who can turn into a cosigner on FHA loans with unfavorable credit ratings. All potential cosigners should be both kinfolk or shut buddies. The friendship should be documented to show a prolonged relationship. It’s best to present the rationale why they might be excited about serving to you qualify for a mortgage.

First-time Patrons with Unhealthy Credit score

Are you a first-time purchaser with unfavorable credit ratings? When you’ve by no means owned a house earlier than, there are a lot of packages designed particularly for you. FHA loans are the most effective choices on the mortgage market to help first-time patrons with unfavorable credit ratings with regards to the acquisition of a brand new residence.

As a result of the federal authorities is keen to insure a portion of your house mortgage, lenders usually tend to take a danger on first-time patrons who don’t have a confirmed report of success. They might be extra apt to grant loans to shoppers who’ve low credit score scores or no credit score in any respect.

Compensating Elements

Most FHA loans for unfavorable credit ratings would require a credit score rating of 580 or greater, however some lenders are keen to look past the numbers. The next credit score rating will usually offer you extra advantages, corresponding to a decrease down fee of three.5 p.c. Nonetheless, lenders will usually enable for compensating elements when you’ve got poor credit score.

- Excessive Down Cost

A down fee has been used traditionally to present lenders some peace of thoughts in case you default on the mortgage. With some small quantity of fairness within the property, they’ve some assure that they are going to be capable of regain a portion of their funding if the house strikes into foreclosures. When you’ve got a decrease credit score rating, the danger of defaulting on the mortgage is way higher and plenty of lenders could also be hesitant to take the danger.

FHA loans for unfavorable credit ratings are often chosen as a result of they characteristic a particularly small down fee quantity of simply 3.5 p.c of the acquisition worth. Nonetheless, people with decrease credit score scores or first-time patrons with unfavorable credit ratings might face a better required down fee. Scores lower than 580 will warrant a 10 p.c down fee in your new residence.

Regardless that this would be the minimal requirement, a better down fee will proceed to weigh in your favor. The more cash it can save you as much as place down on a brand new residence, the extra probably a lender might be to subject a mortgage to first-time patrons with unfavorable credit ratings or no credit score in any respect.

- Massive Financial savings Account

As essential as your down fee is, your financial savings account might be equally vital. Lenders don’t need to see you empty out your complete nest egg with the intention to meet the minimal necessities for a down fee. An underwriter will even be having a look at your financial savings account to make sure that you will have cash in reserve after the closing is over.

Your money reserves are form of like a security web for lenders. Notably when you’ve got a better debt-to-income ratio, one surprising invoice for the month may imply the distinction between paying your mortgage and lacking it. Automobile repairs, an exorbitant cellphone invoice or a medical emergency can all pop up at a second’s discover.

When you’ve got cash in your financial savings account, you’re extra prone to proceed making the mortgage funds. Many lenders favor to see roughly six months’ price of bills in your financial savings account to make up for a decrease credit score rating. First-time patrons with unfavorable credit ratings ought to purpose to have such a emergency fund constructed up previous to making use of for a brand new mortgage.

- Excessive Earnings

Do you will have poor credit score however a excessive revenue? This might be one other actual compensating issue that may make you extra engaging to a possible lender. The next revenue could make your debt-to-income ratio seem a lot smaller and offer you extra wiggle room with regards to making your month-to-month funds.

First-time patrons with unfavorable credit ratings might need to take into account what share of their revenue a brand new mortgage would require. The smaller that share is, the extra probably a lender might be to subject you a house mortgage based mostly in your gross month-to-month revenue.

The next revenue can even make it simpler to satisfy among the different compensating elements corresponding to a better down fee or a big financial savings account. Each of those financial savings varieties will accrue a lot quicker and make you a extra interesting candidate. Even in the event you occur to fall into the class of first-time patrons with unfavorable credit ratings. Lenders simply love their cash upfront.

- Employment Historical past

No lender needs to subject a mortgage to somebody who has a really spotty historical past of preserving a job. Steady and regular employment is a big consider figuring out whether or not you might be eligible for any of the loans out there to first-time patrons with unfavorable credit ratings. Lenders are sure to take a look at a number of years’ price of your employment historical past and should even test your references.

Ideally, they would favor to see you’re employed with the identical employer for at least two years. They might make some exceptions in the event you switch to a special firm however preserve the identical place. Equally, they might take extenuating circumstances into consideration in the event you have been let go because of inside struggles throughout the firm.

Make sure that you will have a protracted historical past of displaying as much as work diligently at your scheduled occasions with the intention to qualify based mostly on this compensating issue.

Unhealthy Credit score Residence Loans After Chapter

Many people imagine they might by no means be capable of personal actual property once more after declaring chapter. You could have confronted some rocky monetary occasions previously, significantly in an financial downturn. Nonetheless, you should still have an opportunity at homeownership based mostly on tips established to assist potential patrons qualify following a chapter.

These “second probability residence loans” have their very own {qualifications} and eligibility standards. To accommodate the distinctive circumstances that people who filed for chapter might face, all mortgage merchandise now provide particular ready durations. These ready durations offer you time to rebuild your credit score and set up your self financially as soon as extra.

On the whole, you possibly can anticipate finding these ready durations of various residence loans:

FHA loans:

VA loans:

Standard loans:

USDA loans:

When you confronted an extenuating circumstance that resulted within the lack of revenue outdoors of your management, chances are you’ll qualify for a brand new mortgage even sooner. Each typical mortgages and FHA loans for unfavorable credit ratings will subject these exceptions. A traditional mortgage solely requires a two-year ready interval and an FHA mortgage requires solely a one-year ready interval on this state of affairs.

Foreclosures and Ready Intervals

Once you expertise a lack of revenue, it may be extraordinarily difficult to make ends meet on a month-to-month foundation. Many houses will transfer into foreclosures to assist decrease month-to-month prices, however that will not be sufficient to cowl the price of your mortgage. Finally, your lender will need to search fee for the rest of the stability in your mortgage.

Let’s suppose that you just nonetheless owe $100,000 on the house you bought ten years in the past. You instantly misplaced your job, and the financial institution moved the house into foreclosures. On the public sale, the house might have solely bought for $75,000. Sadly, your lender nonetheless isn’t pleased with this $25,000 discrepancy within the worth distinction.

Relying in your state legal guidelines, a lender could possibly file this $25,000 as a deficiency which you’ll nonetheless owe. Many people are unable to cowl the price of the deficiency, so that they file for chapter to erase the debt.

In different situations, a household might file for chapter earlier than the house strikes into foreclosures. Dropping the house could also be part of the chapter course of. The order wherein these processes happen may decide how lengthy it’s a must to wait earlier than you take into account homeownership once more sooner or later.

If the foreclosures of your earlier residence occurred earlier than you filed for chapter, the ready interval will start from the chapter date.

If the foreclosures of the house occurred after the chapter date, chances are you’ll face totally different ready durations. For instance, FHA loans for unfavorable credit ratings will then require a three-year ready interval. Standard mortgages will nonetheless will let you base the ready interval on the chapter discharge date.

What Can You Do Throughout the Ready Interval?

When you’re trapped in one in every of these lengthy ready durations, you don’t essentially have to sit down idly and await the times to go. You should have a higher probability of receiving a mortgage sooner or later if you’ll be able to take some steps towards actively rebuilding your credit score. It can take a number of laborious work and dedication, however it’s doable to create a very good credit score rating after chapter.

One of the best factor you are able to do is open credit score accounts after which constantly pay the invoice every month. A bank card with a decrease most is a good way to apply borrowing cash and repaying it responsibly every month. Take into account that lenders favor to see you utilize the credit score restrict responsibly. Most specialists advocate preserving your spending to thirty p.c or much less of the out there credit score restrict.

You also needs to make an effort to pay all your payments in a well timed method. This will embody your cellphone invoice, car loans or pupil loans, automobile insurance coverage, or cable. Whereas they might not in the end report these things to the credit score bureau, some lenders will take into account various types of credit score while you apply for a mortgage.

The purpose throughout the ready interval is to ascertain wholesome monetary habits that exhibit your creditworthiness. Make your self a calendar that reveals which payments are due on particular days so that you by no means miss a fee.

Tips on how to Enhance Your Credit score Rating

At all times a good suggestion

Bettering your credit score rating is critical if you wish to obtain a brand new mortgage or discover extra favorable phrases. You’ll discover advantages that far surpass simply the flexibility to buy a brand new residence. Scholar loans, auto loans, and bank card firms are all extra prone to subject you a credit score restrict in the event you can enhance your credit score rating.

Sadly, many people assume that enhancing their credit score rating is just too difficult. It does take time to undo the injury you wreaked in your credit score, nevertheless it isn’t an unattainable feat. All it’s worthwhile to do is change a handful of your monetary habits to exhibit to lenders you can be trusted to pay again your mortgage. Habits are laborious to build-up, however there may be nothing supernatural in that. You are able to do this!

Make Funds on Time

That is maybe one of many best methods to mechanically enhance your credit score rating. People who’ve a protracted historical past of paying their money owed every month in a well timed method usually have a lot greater credit score scores than those that don’t. Whereas this will appear extraordinarily tough, you need to keep in mind that advances in expertise make paying on time simpler than ever.

The best method to make sure your payments receives a commission every month is to enroll in auto-pay. Most firms provide an auto-draft characteristic by means of their on-line fee portal. Signing up and providing your checking account info is a fast and simple technique to be sure you always remember a selected fee once more.

If a few of your payments don’t have this characteristic, chances are you’ll need to take into account setting an alarm in your telephone. Make it possible for it’s set to recur month-to-month so that you just by no means miss one other fee. This may make it simpler to seek out unfavorable credit ratings residence loans sooner or later.

Scale back or Remove Debt

One other easy method to enhance your total credit score rating is to cut back or remove a few of your debt. Lowering your debt makes you a extra engaging prospect to lenders as a result of it lowers your debt-to-income ratio. A decrease ratio makes you much less of a danger to lenders and means that you can qualify for a greater mortgage.

Many individuals with poor credit score may have a number of open bank cards, every with a various stability. You could have a handful of playing cards with comparatively low balances and solely a pair with greater minimal month-to-month funds. Among the finest methods to scrub up your credit score rating is to repay among the playing cards with decrease balances.

This easy maneuver has two advantages. First, it helps to clear among the excellent accounts which are generated by your credit score report. Second, it frees up some cash every month so that you can put towards your bigger money owed.

Please take a second to learn our article on get credit score scores for the most effective mortgage charges.

Unhealthy Credit score Residence Loans Conclusion

Your credit score rating is a major issue for lenders to contemplate when issuing a brand new mortgage. Nonetheless, poor credit score doesn’t essentially exclude you from the prospect of buying your individual residence. Low credit score residence loans are pretty plentiful if you realize the place to look.

Sadly, unfavorable credit ratings residence loans don’t at all times provide essentially the most favorable phrases. It’s essential to begin taking some proactive steps to enhance your credit score now so you possibly can qualify for higher mortgage merchandise sooner or later. One of many easiest issues you are able to do to your credit score proper now could be to seek out out the place you stand.

Ask for a replica of your credit score report from one of many three credit-reporting companies. Each client is entitled to a free report annually. Realizing your credit score rating and historical past will help you to make clever choices to enhance that quantity within the years forward. Be certain you are taking the time to evaluation the credit score report fastidiously, as there are typically errors.

When you spot an error that might be blemishing your credit score, contact the credit-reporting company and the supply of the error. You could possibly resolve the difficulty shortly and in the end enhance your credit score rating.

Examine the potential of qualifying for one of many authorities packages corresponding to an FHA mortgage for unfavorable credit ratings. They arrive with vital benefits {that a} typical mortgage product has a tough time competing with. Specifically, they usually characteristic extraordinarily low down funds which might make homeownership a extra fast actuality for most people. Additionally, pay attention to doable scams and know your rights when taking a look at doable credit score restore packages.

Don’t overlook that persevering with to pay down your debt can even provide an enormous enhance to your potential to qualify for a brand new mortgage. Lowering your debt-to-income ratio does make you rather more engaging to lenders and lowers the danger of defaulting on unfavorable credit ratings residence loans.

Finally, there are many steps you possibly can take to begin enhancing the percentages of qualifying for unfavorable credit ratings residence loans as we speak. You can begin by contacting among the native mortgage firms in your space to see whether or not you would possibly meet the standards for one in every of these authorities packages or another sort of unfavorable credit ratings residence mortgage as we speak.

You continue to bought questions? We nonetheless bought solutions!

FAQ About Unhealthy Credit score Residence Loans

Are unfavorable credit ratings residence loans assured?

Whereas they don’t seem to be assured, we do work with householders who’ve a low credit score rating to assist them discover the right unfavorable credit ratings residence loans program. Low credit score mortgage loans such because the FHA mortgage, VA mortgage, and USDA mortgage are all out there for people who can qualify.

Can I get a house mortgage with a credit score rating below 550?

Sure, you possibly can qualify for unfavorable credit ratings residence loans with a credit score rating below 550. Every lender may have their very own benchmarks and standards for potential candidates, however a decrease credit score rating will usually require extra compensating elements. These can embody a protracted historical past of regular employment, excessive revenue, or a bigger down fee out of your financial savings account.

Can I get a USDA mortgage with unfavorable credit ratings?

The minimal credit score rating for a USDA mortgage is 640. Nonetheless, you could possibly discover a lender who’s keen to manually underwrite a mortgage for decrease credit score scores. You’ll need to have just a few compensating elements, which might embody:

- Massive money reserve to pay for a number of months’ price of mortgage and curiosity funds

- Potential for a increase within the close to future

- Comparable housing fee presently

- Low debt-to-income ratio

- Low whole obligation ratio

Can I get a house mortgage after chapter?

Sure, second probability unfavorable credit ratings residence loans can be found after a ready interval. The shortest ready interval comes with the FHA Again to Work program and requires you to attend no less than one yr after a foreclosures or chapter discharge. To be able to qualify for this program, you should have had extenuating circumstances that led to your monetary hardship. These circumstances can embody:

- Lack of 25 p.c of your whole revenue or extra

- Laid off or fired from the present place

- Medical situation or incapacity

You have to exhibit that you’ve got moved on from this monetary hardship, established constructive fee historical past for the previous twelve months, and are presently financially steady.

How briskly can I increase my credit score rating?

Bettering your credit score can take time since you should construct a historical past of accountable funds and accountable cash administration. Work on diligently paying your month-to-month payments on time every month and lowering a few of your total debt. These two main steps will help you to attain a decrease credit score rating in time.

What’s the HOPE program?

The HOPE program final gave out funds in 1994, however this program helped to fund grants that made homeownership extra probably for low-income households in public housing. Cash was made out there to public housing authorities, resident administration companies, housing cooperatives, and related companies with the intention to train essential expertise corresponding to:

- Job coaching and different actions to extend financial empowerment

- Monetary help program availability

- Rehabilitation of properties

- Resident and homebuyer counseling and coaching

Can I get unfavorable credit ratings residence loans with no down fee?

Sure, you possibly can safe unfavorable credit ratings residence loans with no down fee. Many packages would require some sort of down fee to grant safety to the lender, however authorities packages just like the USDA residence mortgage or VA mortgage don’t require a down fee.

Can I get a primary time residence patrons mortgage with unfavorable credit ratings?

Sure, first-time patrons with unfavorable credit ratings can nonetheless qualify for a mortgage, significantly if the mortgage is one in every of a number of unfavorable credit ratings residence loans. Lenders could also be extra hesitant to subject these loans except there are clear compensating elements like a bigger down fee or a better rate of interest.

You might also qualify for packages just like the FHA unfavorable credit ratings residence loans. These packages are designed to assist first-time patrons with unfavorable credit ratings to obtain a mortgage with a low down fee.

The place can I discover inexpensive credit score counseling?

America authorities has a web site with a ton of useful info on low price or free credit score counseling in addition to unfavorable credit ratings residence loans.

References

Residence Loans for Single Moms

10 Ideas For Refinancing Your Mortgage in 2020

HUD Permitted Housing Counseling Companies

Homeownership and Alternative for Individuals In all places (HOPE I)Making Residence Reasonably priced

Unhealthy Credit score Residence Loans in Chicago

Unhealthy Credit score Residence Loans in Columbus, Ohio

Unhealthy Credit score Residence Loans in Virginia

Qualify for a Mortgage with Unhealthy Credit score

First Time Residence Patrons Information: Dealing With Low Credit score Scores

Unhealthy Credit score Residence Loans in Washington State

Possibility for Getting a Residence Mortgage After Chapter

Mortgage Attainable with Credit score Issues

Discovering Residence Loans for Unhealthy Credit score (Sure, You Can)

Private Loans for Individuals with Unhealthy Credit score or No Credit score